As technology continues to evolve and stamp its presence in today’s businesses, the restaurant industry is bound for a dramatic change. Even today, in 2015, you can walk into McDonald’s and Wendy’s across the country and recognize technology in their business models.

The following are ways that technology will change restaurants.

- Digital Ordering and Payments

- Upgraded Seating and Fixtures

- Online Reservations

- Virtual Menus

- More Environmentally Friendly and Efficient Kitchen Equipment

One of the most dramatic and widespread changes coming to the restaurant industry is the use of digital ordering and paying. Apple has made a substantial move in that front, with the introduction of their mode of digital payment, Apple Pay. Don’t be surprised if you see more tablets and monitors around the restaurant than waiters and waitresses. With company’s always looking for ways to cut costs, one of the first things to go are staff members. Believe it or not, but implementing digital ordering and payment platforms are actually much cheaper than paying an employee to wait a table. Think of it, a waiter/waitress can only wait on one table at a time, before moving onto the next table. With the help of technology, restaurants can service more customers with more efficiency and less sweat equity.

Another change that is coming to restaurants around the country, is the aesthetic look of fast-food and fast-casual chains. The lines between industry segments will blur further, with quick-service chains adopting the upscale decor of casual-dining competitors — localized through art and graphics — and full-service and fast-casual brands adopting tools to speed up service (Restaurant News).

Now, although technology is going to have a major influence on faster serving and smaller chain restaurants, it will have less of an influence on upper-scale restaurants. The use of digital ordering methods do not fit-in with the business model of upper-scale restaurants, as they often pride themselves on customer service and one-on-one attention. However, technology will have a presence at these types of restaurants, it just will not be found in the ordering process, it will be found in the kitchen equipment. There will be a wide array of energy-efficient unit models, and savvy heating and cooling equipment. Restaurants of the future will also find it easier to recycle or compost all waste, as technology will make it one seamless process.

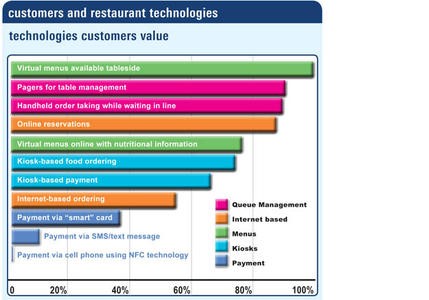

One interesting article that I found while researching the presence of technology in the restaurant industry. Cornell University conducted a research experiment to understand consumers’ reactions to technology innovations in restaurants. They wanted to do this in order to better understand which innovations restaurants should adopt. The chart below shows various technology innovations that could be found in restaurants today. As you can see, virtual menus to online reservations were some of the most sought after innovations.

What this research tells us is that customers want a better form of ordering and service, whether that is with virtual menus or pagers for table management. Another easy implementation that restaurants can take advantage of is the mode of online reservations. With people almost constantly on their phones throughout the day, being able to reserve a table online is seen as a convenience.

The restaurants of the future will be full with new technological innovations, and it will make the process of ordering and paying easier for customers, undoubtedly leading to success within the industry.